2021 electric car tax credit california

Qualified vehicles are light-duty electric vehicles EVs fuel cell electric vehicles FCEVs and plug-in hybrid electric vehicles PHEVs the California Air Resources Board CARB has. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years.

Ev Tax Credits Will Be Back For Popular Brands If Law Passes

SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40.

. Discover electric vehicle tax credits in California and buy a new Toyota PHEV at our Victorville Toyota dealer. Electric Vehicles Solar and Energy Storage. The new law created beginning in 2023 a commercial clean vehicle tax credit for fully electric cars plug-in hybrid electric vehicles and fuel cell vehicles.

Toyota Prius Prime Plug-in Hybrid. The credit begins to phase out for a manufacturer when that manufacturer sells. Beginning on January 1 2022.

Updated December 2021. For vehicles acquired after 12312009. And April 7 2021.

Learn more about EV tax rebates in CA. The electric vehicle tax credit or the EV credit is a nonrefundable tax credit the IRS offers taxpayers who purchase qualifying plug-in electric or clean vehicles. Vehicle Vehicle Type Full Credit.

Up to 1000 tax credit to switch. The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. The credit is available.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. This nonrefundable credit is. In addition to federal tax credits many states also offer rebates when you purchase or lease an electric vehicle.

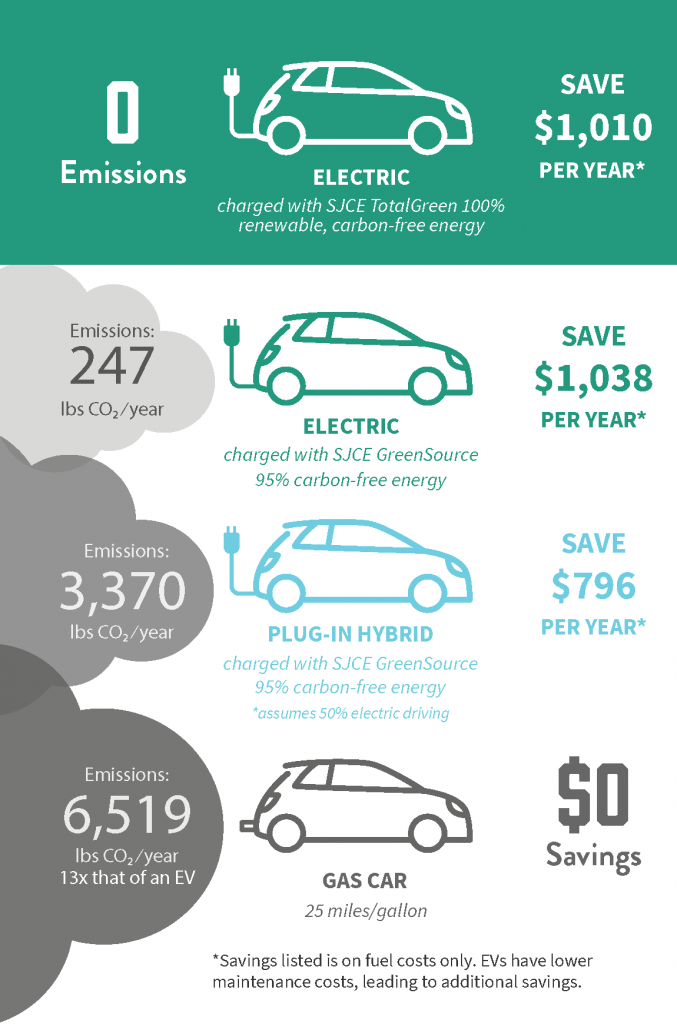

4500 for fuel cell electric vehicles FCEVs 2000 for battery electric vehicles 1000 for plug-in hybrid electric vehicles. A good rule of thumb for people thinking of purchasing an EV. 7000 grant based on income eligibility.

The federal electric vehicle tax credit up to 7500 is based on the vehicles battery pack not the price. Those who bought an eligible electric car before the adoption of the Inflation Reduction Act on August 16 2022 should qualify for the previous federal tax credit of up to 7500. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost. 2021 Electric Vehicles Tax Credits. Federal Electric Car Incentive.

Commercial Solar Electric System. Find current credits and repealed credits with carryover or recapture provision. The credit amount will begin to drop and eventually completely phase out when the.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. The amount you receive may also be based on income eligibility. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles.

The credit amount will vary based on the capacity of. Local and Utility Incentives. The amount varies depending on the state you live in but you can expect to receive anywhere from 500 to 5000 back with your purchase or lease.

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

U S Democrats Propose Dramatic Expansion Of Ev Tax Credits That Favors Big Three Reuters

What Are The Benefits Of Owning A Hybrid Ev In California

This New Incentive Helps Pay For Your Next Electric Vehicle Here S The Catch Pbs Newshour

The Cheapest Electric Vehicles On Sale Under 35 000 In 2021

Program Reports Clean Vehicle Rebate Project

What Car Buyers Should Know About The Coming Tax Credits For Evs Los Angeles Times

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

How Does The Electric Car Tax Credit Work U S News

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Are Ev Tax Credits Back On The Table Maybe E E News

California Wants Everyone To Drive Evs How Will Low Income People Afford Them California The Guardian

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

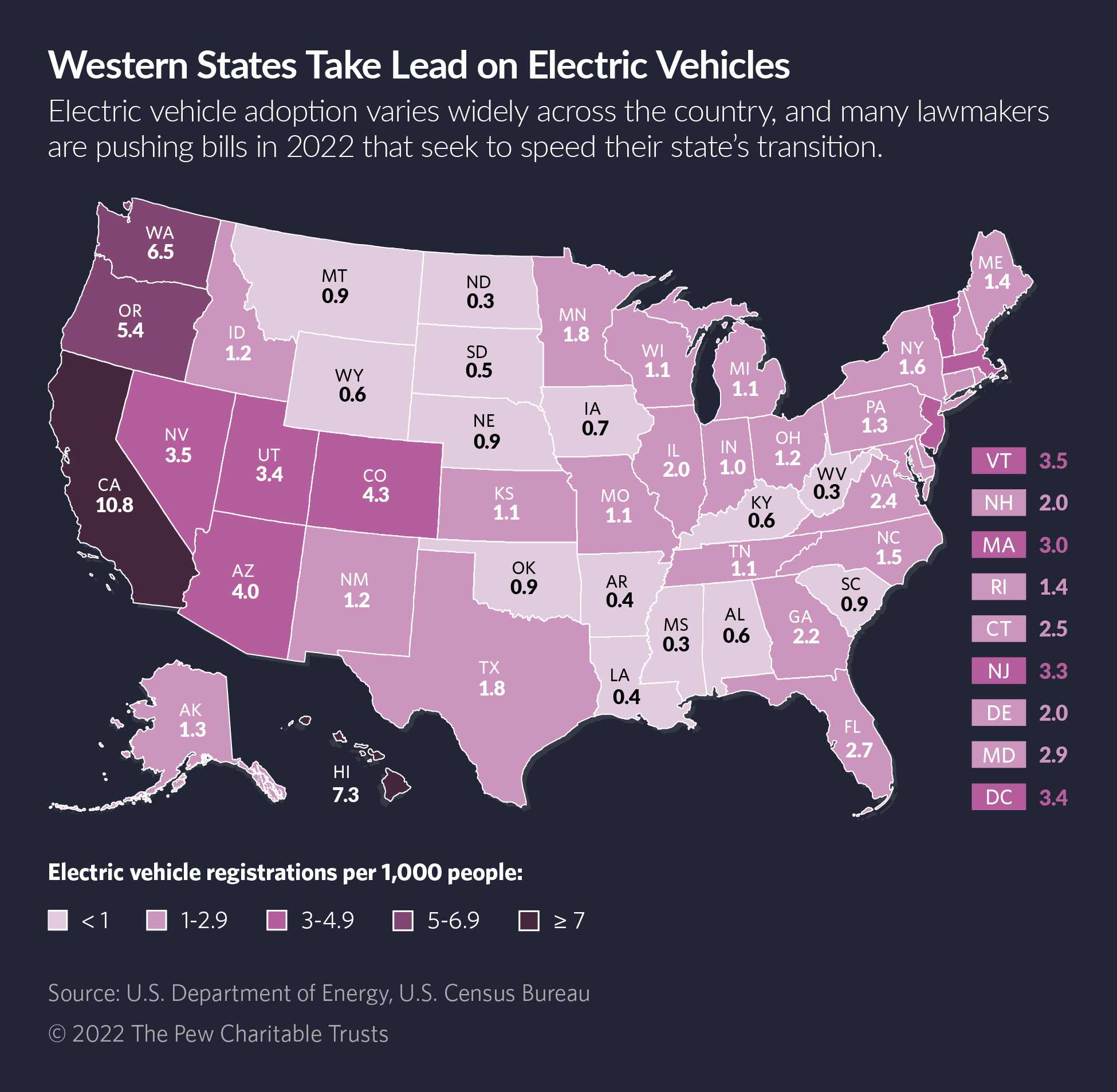

Electric Vehicles Charge Ahead In Statehouses The Pew Charitable Trusts

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Veloz California Ev Market Continues Strong Growth Q1 Strongest Quarter To Date 16 32 Market Share Green Car Congress

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News